Drive More Loan Completions With Smart Follow-Up

Meera helps lending teams reduce drop-offs by automatically following up with stalled applicants, collecting missing documents, and moving loans forward.

THE PROBLEM

Most Loan Applications Don’t Make It to the Finish Line

Leads Go Cold Before You Can Respond

Document Requests Cause Drop-Offs

Your Team Can’t Chase Everyone

How Meera Helps Lending Teams Convert More Applicants

1

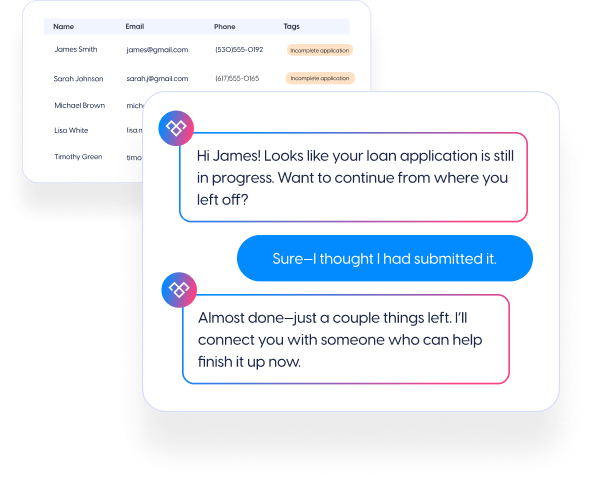

Identify Incomplete Applications

Meera tracks loan applications that are started but not submitted—and flags them for follow-up before the lead goes cold.

2

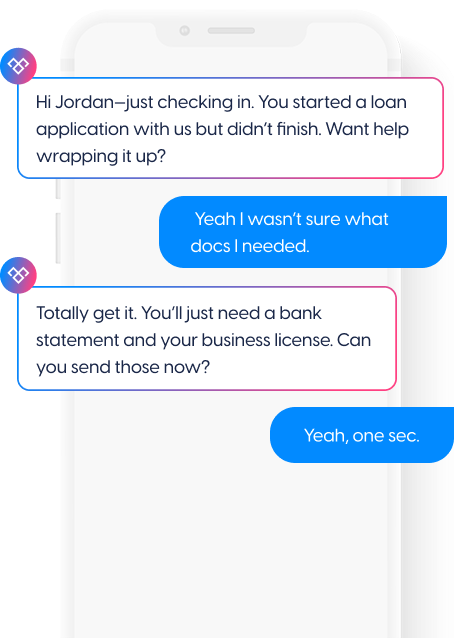

Re-Engage Borrowers With Friendly Reminders

Applicants receive a personalized text or WhatsApp message nudging them to complete their application—sent at the right time, automatically.

3

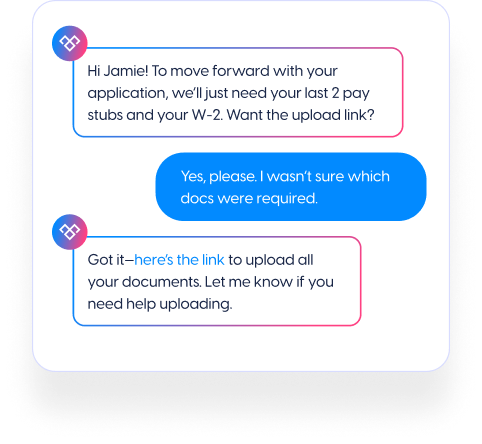

Collect Documents Through Conversation

Meera requests required documents in chat, explains what’s needed, and shares upload links—making it easier for borrowers to respond.

4

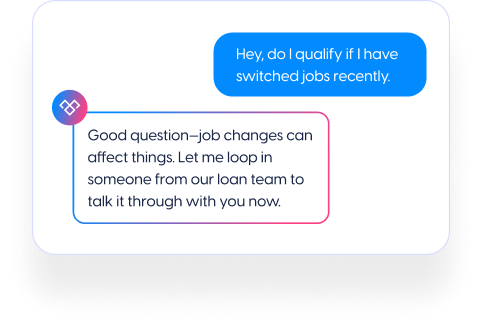

Answer Questions Instantly or Escalate

When applicants are confused about terms, eligibility, or next steps, Meera answers instantly—or loops in a loan officer if needed.

5

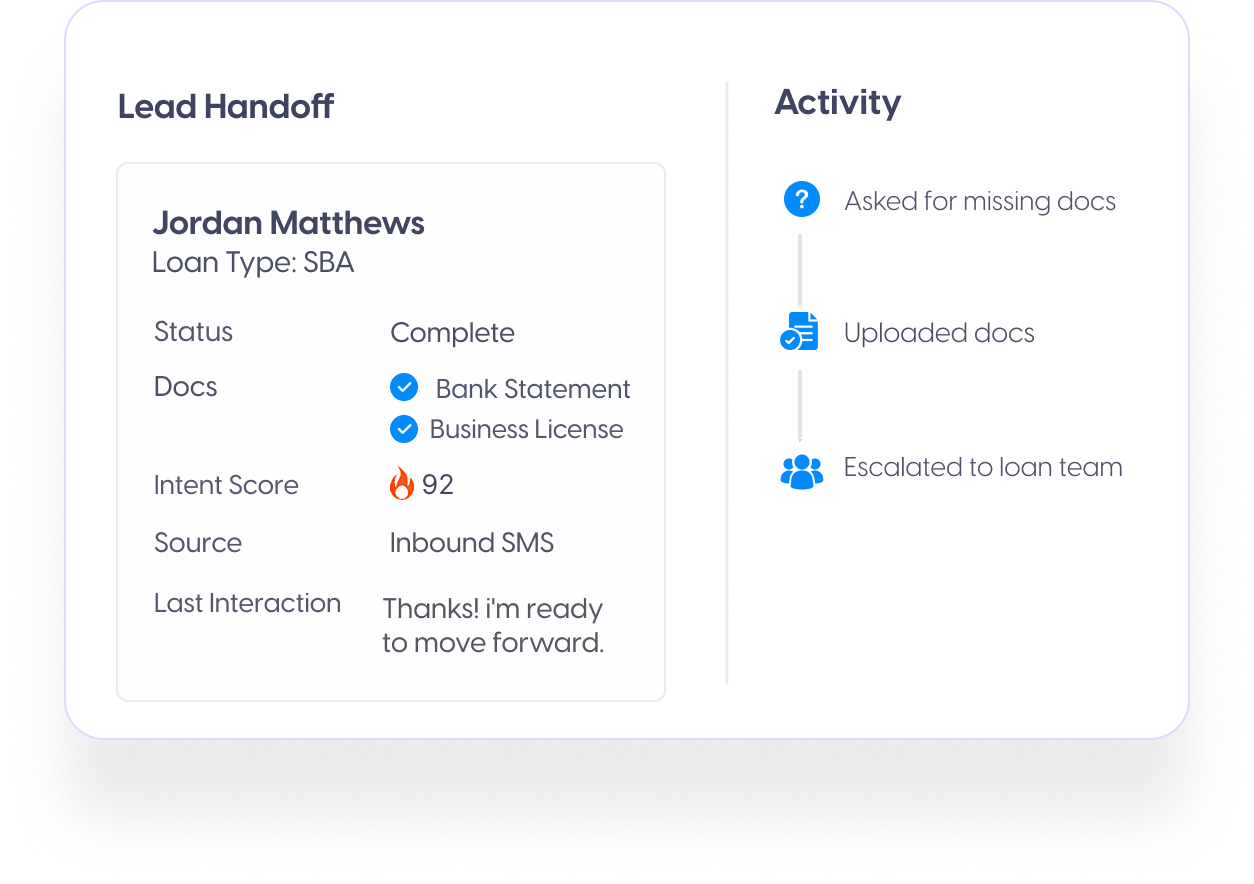

Push Qualified Leads to Your Loan Officers

Once everything is in, Meera routes completed applications—plus conversation history—straight to your CRM, saving your team time.

.png?width=512&height=512&name=guru%20(1).png)

.png?width=199&height=109&name=salesforce-logo1-removebg-preview%20(1).png)

.webp?width=716&height=569&name=banner-img%20(1).webp)