Automate customer re-enrolments Using Meera

Engage at scale and get consent to re-enroll existing insurance customers for the following year.

- Industry: Insurance

- Skill: Re-enrollment

- Function: Service

The Problem

Customer churn rates are one of the biggest problems faced by insurance agencies in current times. With an influx of new players in the market, the competition in the industry is intensifying. This has made retaining customers difficult. Outdated policy renewal procedures lie at the core of the problem. Traditional policy renewal processes are lengthy and can leave customers frustrated. Further, a delay in processing policy renewals gives competitors a window to contact and persuade them. Flaws in the procedure also mars customer experience and can cause significant damage to the business through bad word of mouth.

The Solution

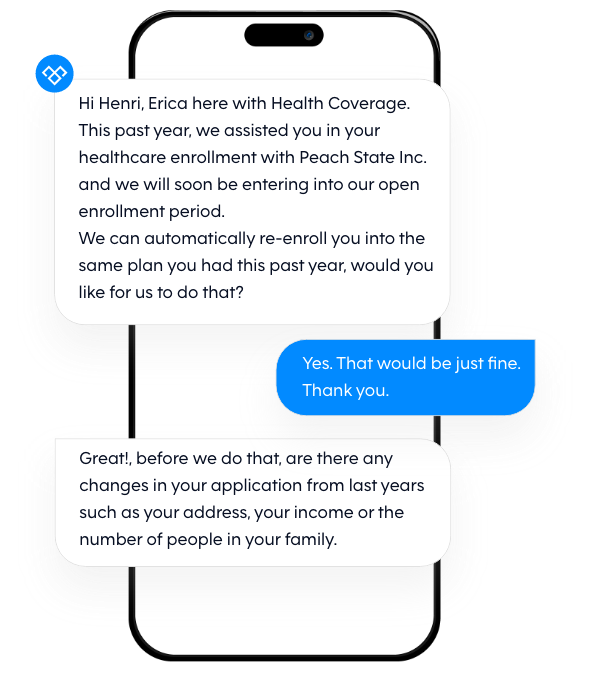

Meera conversational AI provides insurance companies with an effective way to deal with the problem. The insurance AI assistant automates and speeds-up the policy renewal process. It does so, by automatically contacting customers whose policies are due for renewal. Meera makes the process even more effective by using flexible communication channels and personalized messages. This drives response rates and gives sales teams the time to convince customers if they say no. In the case of positive responses, the AI assistant passes the information to the sales teams who initiate the process. Besides this, the AI-powered chatbot warms up customers, denying renewal, for calls with sales representatives. In this way, the insurance AI assistant enables agencies to boost customer retention rates.

Benefits

Reduces Churn

Rate:

Meera automates and speeds up policy renewal processes. By personalizing interactions, AI collects crucial information on customers denying renewals. This aids sales teams in convincing customers and driving them to renew their policies.

Keeps Competitors

at Bay:

Meera automates contacting customers before their policy expiration. By doing so, the insurance AI ensures that the customer does not get bombarded or influenced by competitors.

Enhances Customer

Experience:

The insurance AI assistant simplifies policy renewals for customers. In the process, it enhances customer experiences and satisfaction. This, in turn, creates new upsell and cross-sell opportunities for insurance companies.

Lowers Customer Acquisition

Costs:

By enhancing customer experiences, Meera aids companies in improving their Net Promoter Score (NPS). This, in turn, brings in new customers and reduces the cost of acquisition.

.png?width=512&height=512&name=guru%20(1).png)

.png?width=199&height=109&name=salesforce-logo1-removebg-preview%20(1).png)

.webp?width=716&height=569&name=banner-img%20(1).webp)