Automate Notifications for Loan Disbursements Using Meera

Engage loan prospects using automated text messages to increase loan processing and disbursement rate

- Industry: Finance/Bank

- Skill: Warm Transfer

- Function: Marketing

The Problem

The dawn of the digital age has raised customer expectations from financial lenders. Customers expect lenders to process loans and disburse amounts faster. These preferences have become the key parameters customers use to choose a lender. But financial institutions are struggling to meet customer expectations. The traditional methods of loan disbursement are lengthy and inconvenient for modern customers. With an influx of new players in the market, it has become crucial to disburse loans quicker to convert leads to customers. A delay in loan disbursement could drive customers to another player in the market. Quick and effective communication is the key to ensuring instant loan disbursement. Currently, most customer lenders rely on calling and emailing to communicate with customers. A drastic shift in customer communication preferences has rendered these channels obsolete. There is a drastic need for the industry to roll out more flexible and convenient ways to disburse and process loans.

The Solution

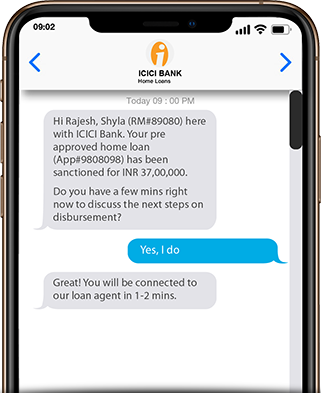

Meera conversational AI offers an effective solution to the problem. The banking AI automates the engagement of loan applicants. It does so by automatically notifying loan applicants about the approved amount. The AI assistant contacts applicants via SMS and WhatsApp. Further, Meera uses personalized messages to capture the applicants’ attention. It then uses these conversations to warm up leads for calls with loan processing teams. Meera simplifies and automates communication between lenders and customers. The process enables banks to streamline loan disbursement and deliver seamless customer experiences.

Benefits

Speeds up Loan Processing

and Disbursement:

Meera automates and personalizes communications between lenders and customers. It improves response rates and engages applicants to speed up loan disbursement and discussions.

Creates Upsell and Cross-sell

Opportunities:

The banking AI assistant personalizes and enhances customer experience. By doing so, Meera makes a profound impression on customers and boosts satisfaction rates. This enables lending institutions to upsell and cross-sell their products and services with ease.

Saves Costs and

Efforts:

Meera works on each loan application at scale. The AI assistant periodically follows-up with applicants and analyzes their intent. Using these skills, Meera filters out non-qualified leads and only passes high-intent opportunities. This enables financial institutions to save big on costs and efforts.

.png?width=512&height=512&name=guru%20(1).png)

.png?width=199&height=109&name=salesforce-logo1-removebg-preview%20(1).png)

.webp?width=716&height=569&name=banner-img%20(1).webp)