Engage Loan Applicants, Automate Follow Ups & Increase Conversions Using Meera

Follow up with existing loan applicants using real-time personalized messages to boost loan processing rates.

- Industry: Finance/Bank

- Skill: Warm Transfer

- Function: Sales

The Problem

Conversations are integral to processing loan applications. Loan approvers require multiple conversations with applicants to evaluate their creditworthiness. The process has become even more lengthy with banking institutions finding it difficult to get hold of loan applicants. Loan processing teams spend hours of their productive time trying to contact leads. As a result, the loan processing rates in the industry are declining. This is due to a drastic shift in consumer communication preferences. Customers today expect convenience and flexibility in communication. Due to this problem, banks are losing out on converting valuable leads.

The Solution

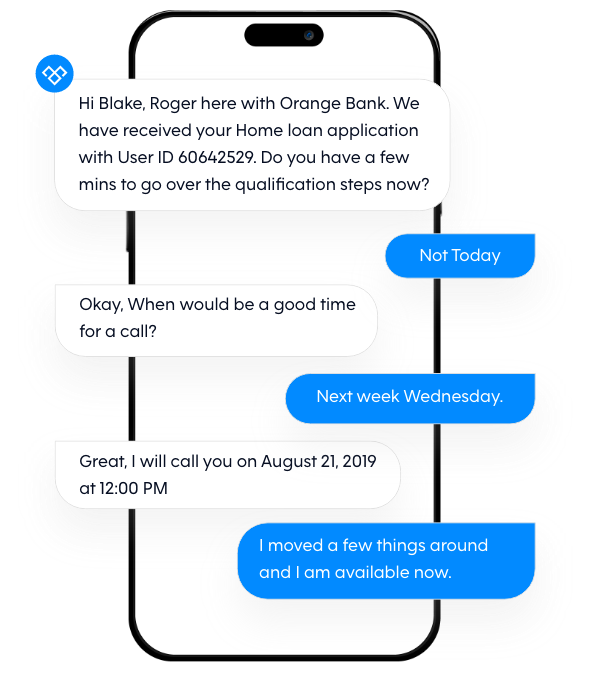

Meera conversational AI presents an effective solution for banks. The AI assistant behaves as an automated follow-up system and engages loan applicants. It does so by sending personalized messages through SMS and WhatsApp. The personalization and flexibility offered by the AI assistant drives leads to respond. Using these conversations, the banking AI warms-up leads for calls with loan processing teams. These boosts contact rates and enables banks to speed up loan processing. Besides this, the AI banking assistant frees sales teams of the repeated task of contacting leads. This enables them to focus on high-intent leads and acquire new customers.

Benefits

Automates Lead

Qualification:

Meera works on each lead at scale and analyzes their intent and readiness. Using these skills, the banking AI only passes qualified and contactable opportunities to sales teams. It nurtures the other leads until they are ready.

Maximizes Revenue:

The banking AI assistant engages applicants and enhances contact rates. By doing so, Meera helps banks improve loan processing rates and maximizes revenue.

Reduces Costs

Meera replaces outbound calling with inbound opportunities. This aids companies in cutting down on phone bills and unnecessary calling.

.png?width=512&height=512&name=guru%20(1).png)

.png?width=199&height=109&name=salesforce-logo1-removebg-preview%20(1).png)

.webp?width=716&height=569&name=banner-img%20(1).webp)