Boost Insurance Lead Contact Rates With Conversational AI

Engage, and schedule conversations with hard-to-reach insurance leads using text-first automation.

THE PROBLEM

Trying to reach leads by phone or email wastes hours of time

Calls Go Unanswered

Emails Get Filtered

Low Contact Hurts Morale

How Meera Connects Insurance Agents With Their Leads

1

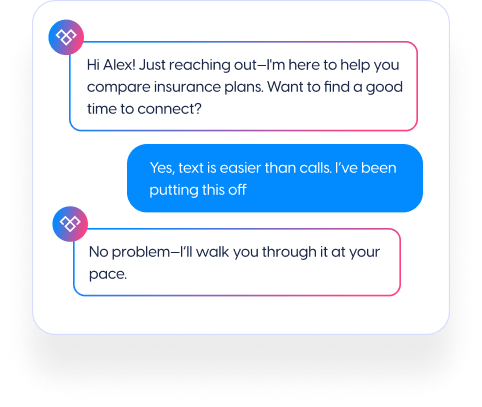

Engage Using The Channels They Prefer

Meera reaches out via SMS and WhatsApp—channels prospects are more likely to engage with—breaking through where calls and emails fail..

2

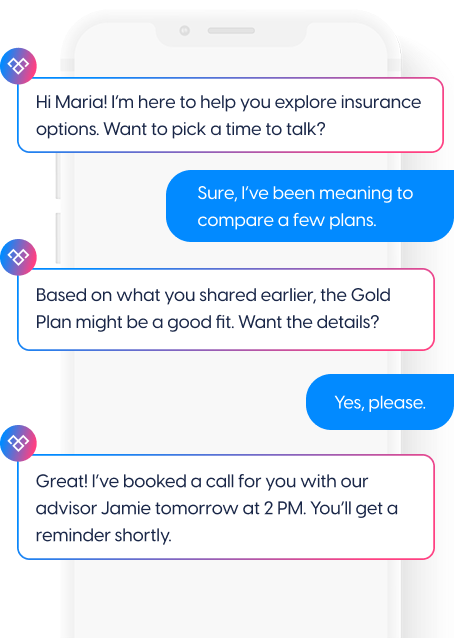

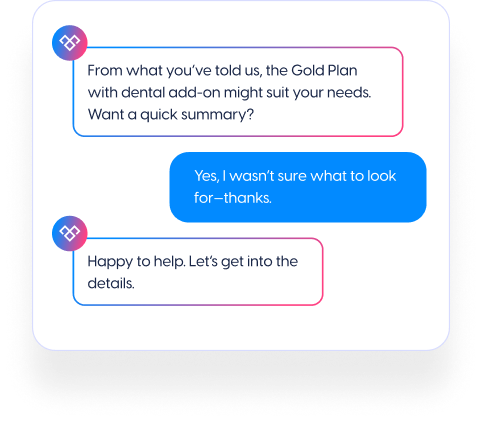

Capture Attention With Personalized Messaging

Using NLP, Meera crafts context-aware messages that feel human and relevant, making leads more likely to respond.

3

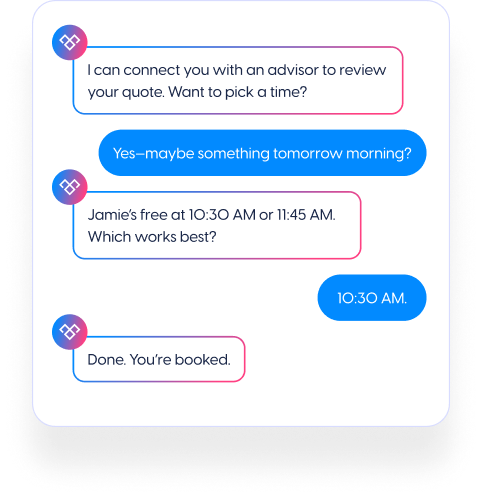

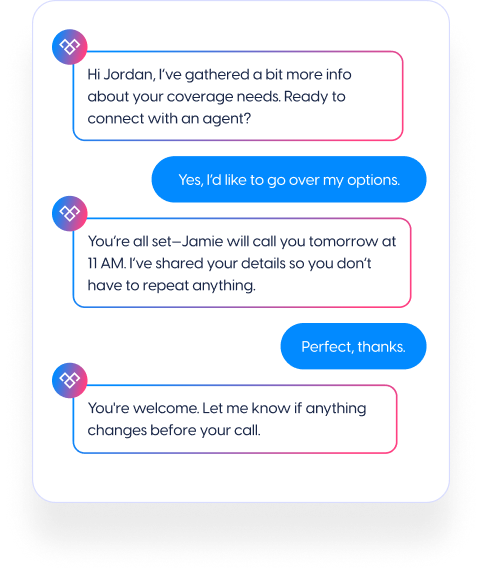

Schedule Calls With Available Agents

Once a lead engages, Meera offers real-time scheduling—booking a call directly between the agent and the warmed lead.

4

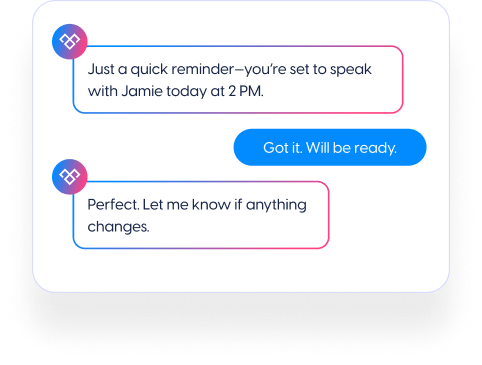

Warm Leads Before the Call

Meera sets expectations and confirms availability before the call, improving showrates and making conversations more productive.

5

Free Up Agents to Focus on Selling

By automating the contact, qualification, and scheduling process, Meera removes busywork so agents can focus on what they do best—closing

We were really shocked and excited to see the increase in lead to enrollment rate by 47%. We knew we would have an impact but not to this extent and we are beyond thrilled with these numbers and looking forward to testing and expanding into different areas in the future

Alicia Slachta

Senior Manager, Growth Marketing, Penn Foster

.png?width=512&height=512&name=guru%20(1).png)

.png?width=199&height=109&name=salesforce-logo1-removebg-preview%20(1).png)

.webp?width=716&height=569&name=banner-img%20(1).webp)