Automate Loan Process Scheduling Using Meera

Engage with loan prospects using SMS, schedule meetings, and accelerate loan processing rate.

- Industry: Finance/Bank

- Skill: Appointment Setting

- Function: Service

The Problem

Customer convenience has emerged as a key differentiating factor across industries. This stands true for the finance and banking industry. Modern customers expect banks to speed up loan disbursement and processing. But the industry is struggling to keep up with these expectations. Most financial institutions still rely on traditional communication methods of calling and emailing. These channels are failing to enable financial institutions to reach out to loan applicants. As a result, financial institutions are spending enormous time in setting up a meeting for loan discussions. This is not only driving customers away but also impacting their Net Promoter Scores (NPS)

The Solution

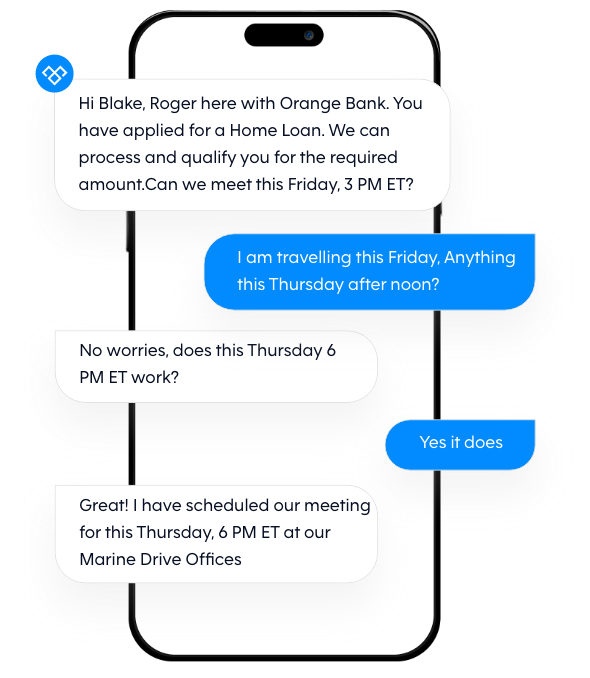

Meera conversational AI offers an effective solution to overcome the problem. The AI banking assistant automates meeting scheduling to speed up loan processing. It does so by contacting loan applicants via WhatsApp and SMS. The AI assistant sends out personalized messages over these platforms to engage applicants. It uses these personalized conversations to drive applicants to respond. Using these conversations, the AI assistant schedules appointment for loan and quotes discussion. With this, Meera enables financial institutions to speed up loan processing.

Benefits

Speeds Up Loan Processing

Meera automates meeting scheduling via flexible communication channels. It drives response rates by allowing them to respond at their convenience. Leveraging the process, Meera empowers banks to engage leads and discuss loans. This saves them a significant time that is otherwise spent in manually scheduling an appointment.

Automates Data Collection

The AI assistant personalizes interactions and uses them to collect customer queries. It then passes this information to loan processing teams. Using the procedure, Meera streamlines and quickens the entire process.

Enhances Customer Experience

Meera simplifies communication and loan processing to deliver seamless customer experiences. The AI assistant aids financial institutions in improving their Net Promoter Scores (NPS). Higher scores help financial institutions in acquiring new customers at low costs and with ease.

.png?width=512&height=512&name=guru%20(1).png)

.png?width=199&height=109&name=salesforce-logo1-removebg-preview%20(1).png)

.webp?width=716&height=569&name=banner-img%20(1).webp)